Waht Credit Card Can You Get With a 570 Score

With a credit score of 550 to 600, there is enough of room for your credit to improve.

If you have good credit, banks may welcome you with open up arms and offer some of the all-time terms. But, yous may non receive this type of treatment in this credit score range.

One of the all-time ways to increase a depression credit score is to use the correct credit bill of fare.

Mostly, information technology can be tough to get canonical for a credit carte du jour when your credit scores aren't the highest. There are specific credit cards that are designed to aid you lot raise your credit, given that you use them responsibly.

If you're looking to build or repair your credit, here are credit cards for credit scores between 550 and 600 that might be right for y'all:

Capital One Platinum Secured

The is an excellent secured credit card for people with 550-600 credit scores largely because of its low minimum opening security deposit.

A $49 security eolith volition instantly grant a $200 credit line.

To get a credit limit of more than $200, you'll take to put in a larger security eolith. By proving a addiction of making on-time payments yous may qualify for futurity credit line increases without the demand for more deposits.

The carte comes with no annual fee. It also comes with MasterCard benefits similar an extended warranty, car rental insurance, travel blow insurance, 24/7 roadside help, and price protection.

Read Majuscule One Platinum Secured Editor's Review

Open Heaven Secured Visa Credit Card

The stands out considering information technology is a secured credit menu that does not require a bank account.

With about other secured credit cards, a savings or checking account is needed. Instead, the security deposit can be funded through wire transfer and money social club.

The card can be helpful for people who don't have a regular bank business relationship when they utilise for a secured credit carte du jour. Additionally, your credit reports are non checked during the approval process.

Read OpenSky Secured Visa Credit Carte Editor's Review

Wells Fargo Secured Visa Credit Card

The Wells Fargo Secured Visa Credit Card is ideal for people who are able to put down a big security eolith -- up to $10,000.

The typical secured credit carte du jour allows a credit line of $3,000 to $5,000. The high credit limit will allow you to make bigger credit menu purchases, but it'll as well contribute to the faster growth of your credit score.

This secured card features a $25 almanac fee. And, Wells Fargo will review your account periodically to run into if your account can exist converted to a regular unsecured credit menu.

Read Wells Fargo Secured Visa Credit Card Editor's Review

Notice it Secured Credit Card

The Discover it Secured Credit Menu is one of the few secured credit cards that happens to have no annual in addition to a cash back program.

Credit cards for people with 550-600 credit scores will rarely offer whatever type of rewards.

The cash back plan offers 2% cash back at gas stations and restaurants (on up to $1,000 in combined purchases each quarter), which are two very pop spending categories.

Meanwhile, all other purchases earn a flat 1% greenbacks back rate. Credit cards that are designed for people less-than-boilerplate credit scores will rarely offering any type of rewards.

The bill of fare doesn't charge a penalty APR or belatedly payment fee for your showtime late payment. To help y'all track your credit progress, you get a free FICO credit score printed on every monthly statement.

As a bonus, yous can accept advantage of other Discover card benefits, such equally $0 fraud liability, no foreign transaction fees, no over-the-limit fee, and your greenbacks back never expires.

What is Your FICO Credit Score

A FICO credit score is the credit score used by the majority of U.Due south. lenders. Information technology is an important part of your finances that they review to determine if you are trustworthy plenty for a credit card, loan, or whatsoever other type of credit line.

FICO stands for the Fair Isaac Corporation, the company that created the formula backside the FICO credit score.

Each credit score is calculated based on the data that is in your credit reports. Your FICO scores may be dissimilar depending on the credit reports pulled.

For instance, there are three major U.Southward. credit bureaus -- Equifax, Experian, and TransUnion. You might get a unlike credit score from each 1.

FICO doesn't reveal the top-secret formula for your credit score. Withal, the factors that brand up your score are available to the public.

FICO Credit Score Factors and Their Percentages

| FICO credit score factors | Percentage weight on credit score: | What information technology ways: |

|---|---|---|

| Payment history | 35% | Your rails record when it comes to making (at least) the minimum payment by the due date. |

| Amounts owed | 30% | How much of your borrowing potential is actually being used. Determined past dividing total debt by total credit limits. |

| Length of credit history | xv% | The average age of your agile credit lines. Longer histories tend to show responsibility with credit. |

| Credit mix | 10% | The different types of active credit lines that you lot handle (eastward.yard., mortgage, credit cards, students loans, etc.) |

| New credit | ten% | The new lines of credit that you've requested. New credit applications tend to hurt you score temporarily. Larn more about FICO credit score |

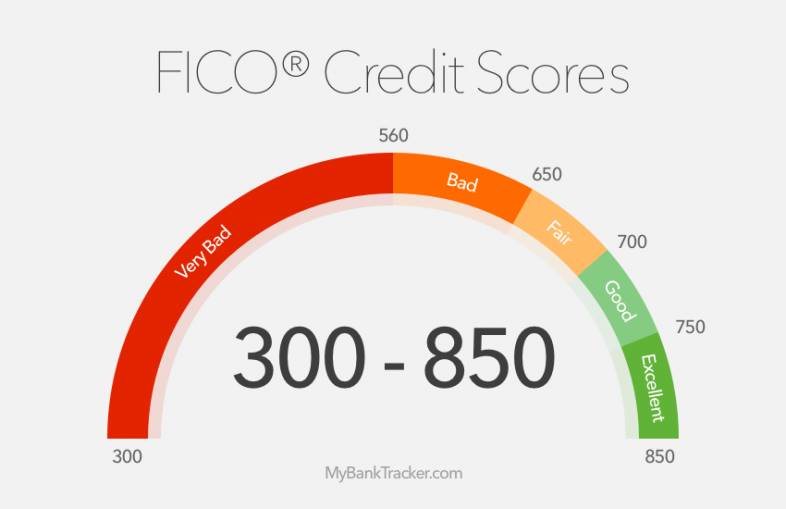

FICO credit scores range from 300 to 850. The college your score, the higher your creditworthiness.

What is a Bad Credit Score

A credit score between 550 and 600 is considered bad credit. Such a score may exist the outcome of negative remarks on your credit reports, including missed payments, bankruptcy, and other delinquencies.

With bad credit, it can exist hard to get approved for credit cards, loans, and other lines of credit.

Lenders may be cautious with lending to people who take struggled with repaying their debt. Fifty-fifty if you practice authorize for a credit line, it is likely that you'll face high fees, interest rates, and less friendly terms.

There are ways to repair your bad credit. There are ways to repair your bad credit. One of the about convenient ways to do so is through a secured credit carte du jour for people with 550-600 credit scores.

The Basics of a Secured Credit Card

A secured credit bill of fare is slap-up for people with 550-600 credit scores, as it is typically difficult to obtain a traditional unsecured credit card with this credit rating.

A secured credit card requires that you provide cash every bit a security deposit, which is normally held in a bank business relationship that is partnered with the lender.

The security deposit acts as collateral in the event that you don't pay off your balance. This is the reason that lenders are willing to offering secured cards to people with bad credit.

Your credit line (the highest possible balance on your card business relationship) is usually equivalent to your security deposit. Therefore, the larger the security deposit, the larger your credit line.

With a secured credit card, the deposit is not used to pay your monthly bill. Secured credit cards tend to come with annual fees and high interest rates.

Rewards programs and premium benefits are rare because the main focus of a secured carte is to rebuild credit.

Other than the security eolith, a secured credit carte du jour works mostly like a typical credit card. Ordinarily, your account activity is reported to the U.S. credit bureaus. It is crucial that your menu issuer does this in order for you lot to repair your credit.

Many banks will review secured credit accounts on a regular basis, ordinarily every 6 to 12 months. If they believe that you're set for information technology, they may offer to convert your secured credit carte business relationship to one that is unsecured.

Or, they may merely offer to refund your security deposit and eliminate whatever annual fees. In either case, it means that you've proven that y'all're able to be responsible with credit again.

Otherwise, you may attempt to use for a regular credit card in one case you experience that your credit score is high enough.

How to Use a Secured Credit Card for a Higher Credit Score

Later qualifying for a secured credit carte du jour, normal usage should suffice to improve credit scores. However, to heighten your credit score quickly, here are tips that can you lot follow:

Prepare upwards automatic bill payments

Credit bill of fare accounts permit customers to automate their monthly bill payments.

This way, you'll never miss a payment, which is of import for improving your credit and increases your chances that the lender will allow you to graduate to an unsecured credit bill of fare.

Put down the highest security deposit possible

Because your credit limit is equal to your security deposit, a large security eolith results in higher borrowing potential.

Use your card, just go on balances low

By maintaining low statement balances, information technology will appear as if you're using only a small-scale per centum of your credit limit. It shows that you can keep your credit card spending and debt under control.

Keep the account open for as long as possible

When yous're ready to graduate to an unsecured carte du jour, reconsider closing the secured credit card. This action would slow downward the progress of your credit improvement because the account age stops growing.

If y'all tin just convert the secured credit card with the same issuer, the account historic period continues to increment.

In the end, your score is only as good equally your credit habits, so you may want to review the fundamentals of skillful credit management, such as paying bills on time, limiting debt, checking your credit report for errors, and limiting credit inquiries.

Source: https://www.mybanktracker.com/credit-cards/best-of-round-ups/best-credit-cards-550-600-credit-scores-258245

Post a Comment for "Waht Credit Card Can You Get With a 570 Score"